NHIF FALL 2018 MEETING

This year’s Northwest Hotel Investment Forum, hosted by Irv Sandman, was held in October at the Hilton Bellevue. The Centerpiece Program was “The Evolution of Wellness Hospitality”. The program also included “Transactions and Operations Performance” with information presented by Hannah Smith, Consultant at STR and Mark Lukens, Managing Director at LWHA.

“The Evolution of Wellness Hospitality”

The panelists for the Centerpiece Program were:

Alfredo Carvajal – President of Delos and Signature Programs (New York, NY)

Lynn Curry – President and Co-owner of RLA Resources for Leisure Assets (Sonoma, CA)

Adam Glickman – Principal at Parallax Hospitality (Atlanta, GA)

Thomas Klein – President and COO of Canyon Ranch (Tucson, AZ)

Wellness is defined as – “The state of being in good health, especially as an actively pursued goal.” Wellness is a trend that has now firmly embedded itself in our mainstream global culture to the tune of $4.2 trillion in 2017, with Wellness Tourism Industry being valued at $639 billion.

“Stay Well” rooms are an example of wellness in hospitality. A Stay Well room at MGM Resorts has wellness features including an air purification system, dawn-simulator alarm clock, shower infuser, aromatherapy, Long Wave night lighting, etc… (some features being the latest wellness technologies from Delos)

- Stay Well rooms provided a financial benefit to hotels through higher room rate differentials, on average, which increase over time, overall satisfaction, and on-property activities.

- Hoteliers need to understand what services consumers are seeking. According to Alfredo Carvajal (President of Delos and Signature Programs), people are seeking Health, Balance and Fulfillment. Every hotelier should stay in their own hotel to understand their property.

- The areas of our life that experience disruption when we travel are our sleep, nutrition, mindfulness and exercise. How can your hotel help ease these disruption for your guests?

- One Hotels, as an example, has meeting rooms with aromatherapy, and the gym has toys as opposed to standard exercise equipment.

- What matters most is the experience the guests remember and this is mostly applicable to full-service hotels. A study from Clemson & Cornell shows that a $3500 increase in per room cost upgrades can achieve a 25% increase in ADR per room.

- There is a 180% premium price for guests that seek wellness.

- Many smaller independent properties seek local partners to assist with on call F & B, massages, etc. For example, Hyatt is doing a lot to incorporate wellness, including buying gym partnerships with local gyms.

- The majority of hotels have the gym in the basement. An improvement could be to move the gym where there is natural lighting or to improve the lighting in the space. Also, there are new creative ways to help guests use apps or online trainers to motivate them to stay fit.

- In the next 10 years we will see more multi-use areas. For example, meditation /relaxation areas adjacent to the gym or lobby. Another improvement could be access to faster & healthier food choices.

- Other wellness ideas include: linens that help keep more moisture in the skin, lighting in the mirrors that provide Vitamin D, healthier mattresses that don’t off-gas as much, less toxic chemicals in the cleaning supplies.

For more information about Wellness, check out these articles:

How Wellness Became Big Business In America – Oct 2018

Wellness Tourism Association Releases Findings From First Wellness Travel Survey at Its Meeting of Members in Quebec City – Sept 2018

“Transactions and Operations Performance”

Looking at Pacific Northwest Hotel Sales Over $2 Million

| Year | # of Sales | Volume (000’s) | Change | Average Price per Room | Change | Median Price per Room | Change |

| 2015 | 71 | $1,225,778 | 14% | $141,840 | 16% | $89,691 | 38% |

| 2016 | 79 | $1,388,063 | 13% | $166,674 | 18% | $85,596 | -5% |

| 2017 | 76 | $742,247 | -47% | $118,684 | -29% | $75,836 | -11% |

| *Source: RCA, Costar, LWHA | |||||||

In 2016 and 2017, the Pacific Northwest had almost the same number of hotel transactions but the deals that closed in 2017 were down on dollar volume (smaller deal sizes). However, in 2018 through the 3rd quarter, deal size increased 66% as compared to 2017 through the 3rd quarter. Average Price per room was up to $160,732 and the median price per room up to $96,169.

- The key change in 2018 has been the purchase of higher quality assets. From April 2018 to October 2018 there were 5 sales over $20 million. During this same period in 2017 there were 0 transactions over $20 million. High dollar transactions of 2018 include:

- Hampton Inn & Suites– Federal Way, WA sold for $33,116,000 ($233,215 per key)

- Kimpton Palladian Hotel– Seattle, WA sold for $42,000,000 ($432,990)

- Red Lion Hotel at the Park– Spokane, WA sold for $34,862,500 ($87,156 per key)

- Hilton Eugene & Conference Center– Eugene, OR sold for $79,700,000 ($290,876 per key)

- BRE Hotel Portfolio 2018 (5 DoubleTree Hotels in Oregon & Washington) sold for $79,100,000

The SWOT for the U.S. Hotel Industry – presented by Mark Lukens

Strengths

- 3rd consecutive year of industry record rooms revenue operating metrics

- U.S. hotels operating a high level of efficiency

- Continued strong asset pricing – YTD 2018

- Nationwide new hotel supply is not devastating

- Banks tighten construction lending standards

- Building labor shortage

- Abundant availability of debt and equity

- Continued low interest and cap rate environment

- Inbound overseas capital chasing yield

Weaknesses

- Negative RevPAR Growth

- S. travel ban efforts create negative postures & restrictions

- Domestic political polarization

- Trade wars

- More hotel brands

- Labor shortage & strong influence of labor unions

- Rising tax burdens & increasing property insurance rates

Opportunities

- Tax Cuts and Jobs Act of 2017

- Industry well positioned to react to any inflation

- Mergers & Acquisitions and spin-offs

- Technology advances = increased operating efficiencies

- Expansion of modular hotel construction

- Sustainability and Eco-friendly hotel initiatives

Threats

- Fear of economic recession never far away

- Strong (though softening) U.S. Dollar

- Rising interest & capitalization rates

- Terrorism

- Geopolitical turbulence reaching a tipping point

- Cyber crime

- Security challenges

- Diminishing importance of physical location

- Redefining social interaction

- Enemy of ADR growth

- Reputation management: real time damage control

- Climatic events

STR Information – presented by Hannah Smith

- Sept 2018 had the first RevPAR declines since 2010 – however this was negative because of one market – Houston, TX.

- Despite the “one negative month” fundamentals remain strong – demand is still outpacing supply (YTD Sept 2018):

- Room Supply –+ 2.0%

- Room Demand – + 2.5 %

- Room Revenue – + 5.1%

- Occupancy – + 0.5 % (67.7%)

- ADR – + 2.5% ($130)

- RevPAR – + 3.1% ($88)

- Most attractive property type for development is Limited Service Upscale and Upper Midscale

- Seattle made the top growing markets list with 2,867 rooms In Construction– a 6.3% increase over the existing supply. Seattle’s total pipeline (including proposed hotels and hotels under construction) includes 50 hotels or 7,870 rooms. The effects of this increase in Supply are showing up in the market. YTD for Sept 2018 showed the following fundamentals for Seattle:

- Room Supply –+ 5.0%

- Room Demand – + 2.4 %

- Room Revenue – + 5.6%

- Occupancy – -2.5 % (77.9%)

- ADR – + 3.1% ($171)

- RevPAR – + 0.6% ($133)

- Seattle also has the highest Labor Cost Growth in the Country at 7.8%

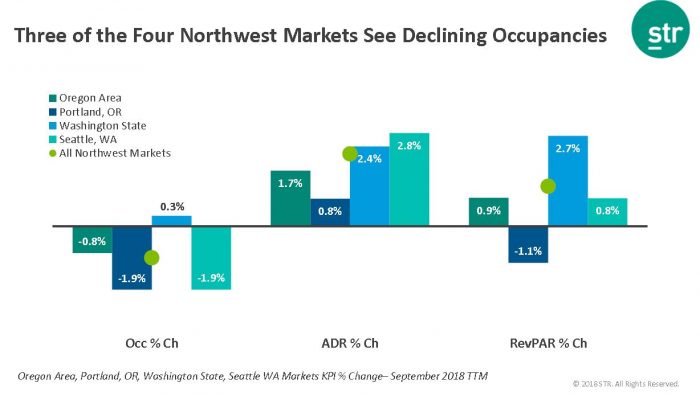

- 3 of 4 Northwest Markets showed Declining Occupancies:

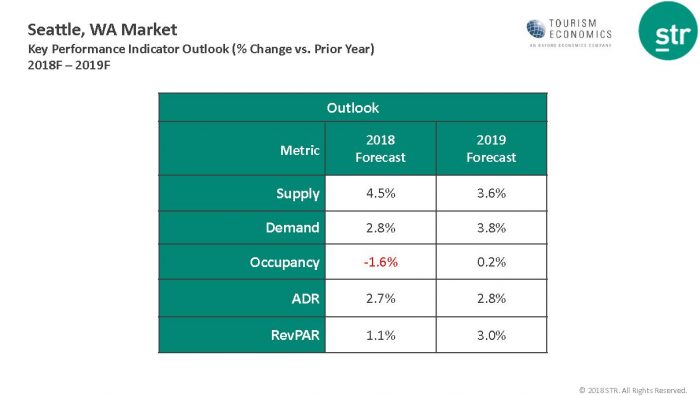

- Seattle market forecast: